single life annuity vs lump sum

For instance if you pass. In all cases Bob would get less from an insured annuity 2500 2545 per month than he would get if he took his pension benefit as an annuity 3000 per month.

Lumpsum Vs Annuity Continuation Youtube

A lump sum gives you capital to make large purchases or invest but your money.

. When opting to receive your lottery winnings in a cash lump sum format you will receive the full total of your winnings minus. Of them all the single life annuity offers the. Left over money from a lump sum can be passed on as inheritance.

Regardless of what your financial advisor or agent recommends. Receiving a lump sum today invest it yourself and live off the proceeds after paying income taxes. If you have health conditions that suggest you could fall well short of that life expectancy then taking the lump sum would make more sense.

Can invest large amounts of the. 2182 per month Lump-sum one-time distribution. 5 Ways to Connect Wireless Headphones to TV.

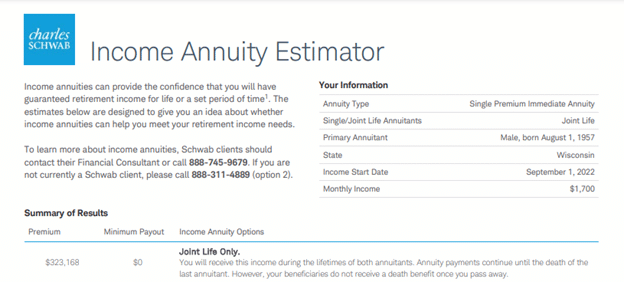

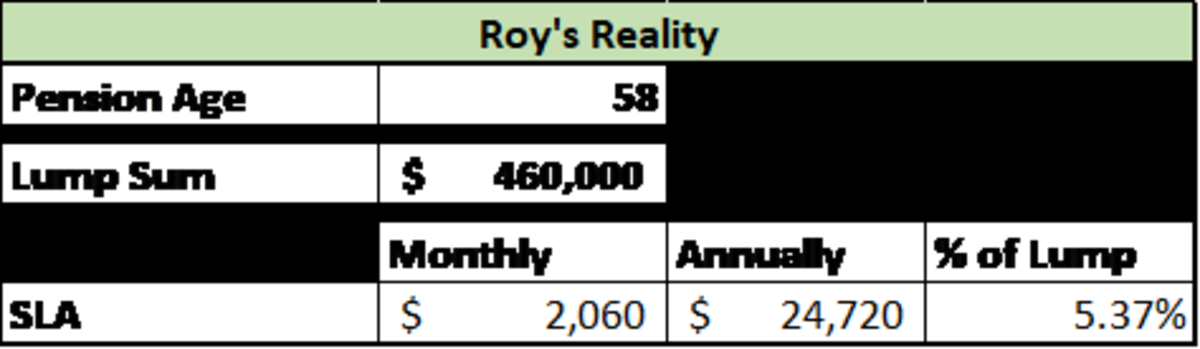

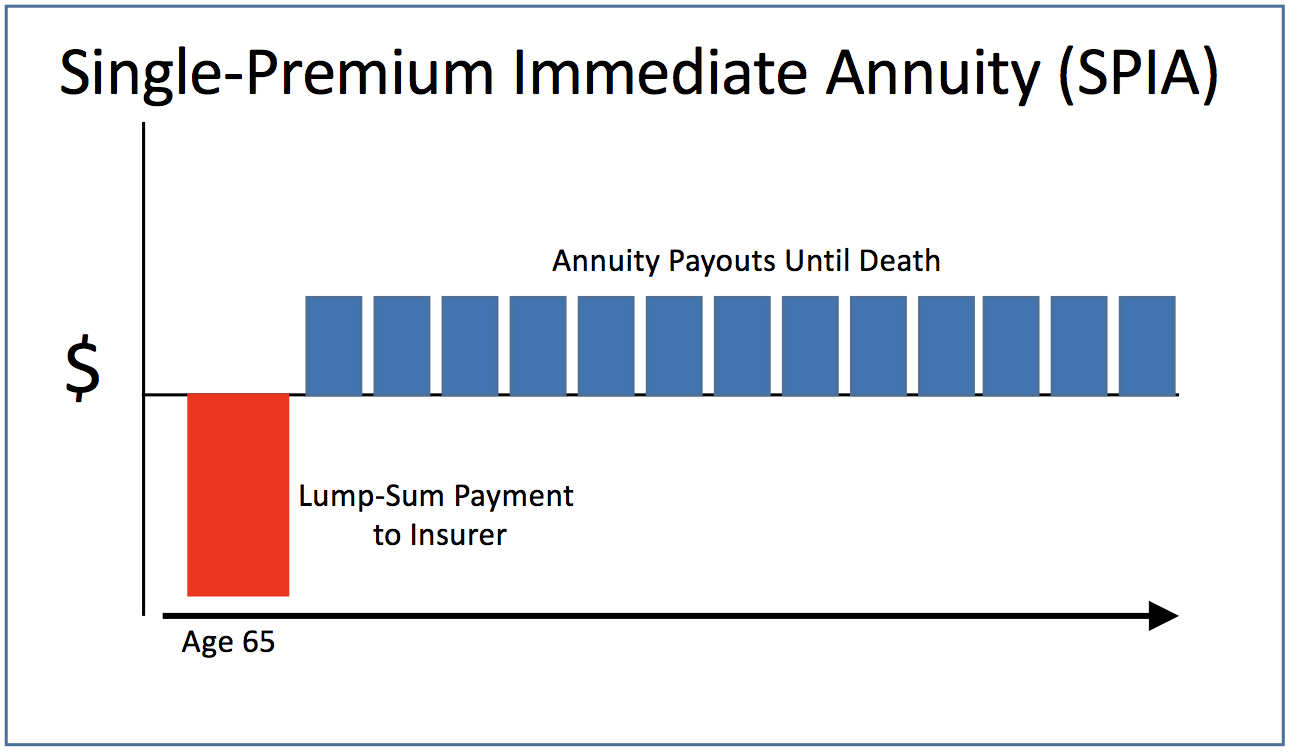

Detailed annuity info told by an annuity product expert not a financial advisor. Individuals with employer-sponsored defined contribution plans or pensions are faced with deciding between receiving a lump sum or life annuity pension payout. Your lump sum vs annuity decision comes down to if you need a lifetime income stream or not.

It can be utilised for childrens education or marriage or to pay off any ongoing. The end result shows that the present. If youre a single female and your monthly annuity is valued at 351000 and the lump sum pension offer is 400000 then you can see the lump sum is worth about 14 more.

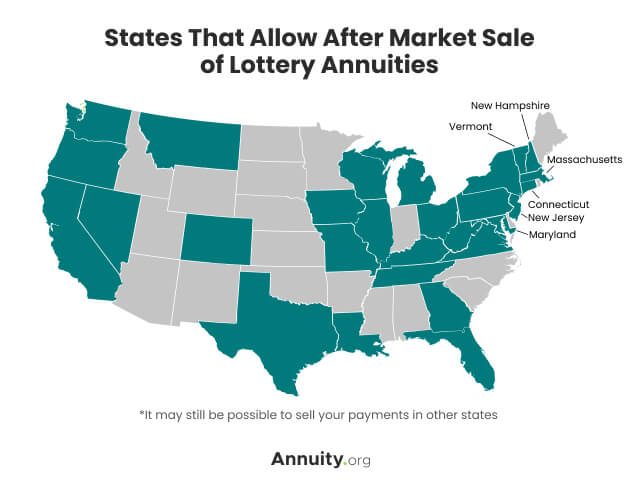

Or receive an annuity for a specific number of. Buy annuities life insurance burial insurance travel insurance and long-term care insurance online. Often referred to as a lottery annuity the annuity option provides annual payments over time.

A lump sum involves. Surface Studio vs iMac Which Should You Pick. You can choose to receive your pension as a single lump sum or as regular annuity payments over time.

Projected annual income needs. Ad Get this must-read guide if you are considering investing in annuities. Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an.

At first glance the annuity may appear to be the clear winner as 17640 per year 1470 x 12 months amounts to an annual payout of 59 on 300000 17640 300000. The difference between the two options is rather stark. If You Must Go with an.

This tool compares two payment options. One of the things to think about when deciding between an annuity vs a lump sum is your age. 347767 to be rolled over to his.

A lump sum amount can help in small and big adjustments after retirement such as moving cities. If you are still relatively young and likely to have a long retirement ahead. Lottery winners can collect their prize as an annuity or as a lump-sum.

You have access to the assets if there comes a time in your life when you may need cash and having control over the assets grants you that option. You can pay large debts off quickly. 100 joint and survivor annuity.

1931 per month Life annuity with 10 years certain. Single life annuity. Regardless of what your financial advisor or agent recommends your lump sum vs annuity decision really comes down to if you need a lifetime income stream or not.

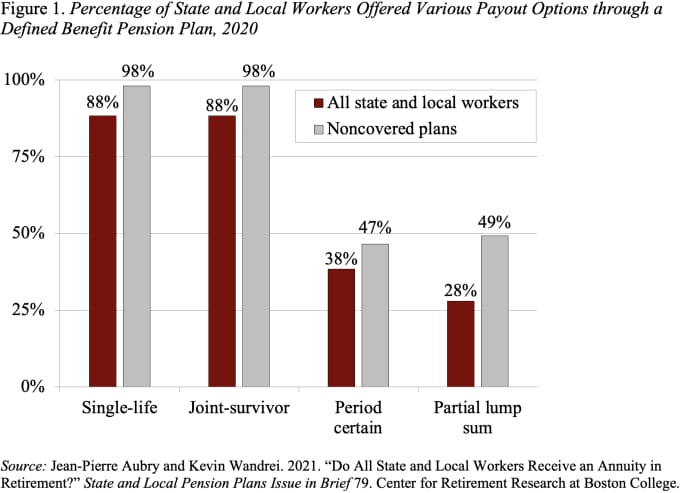

Do All State And Local Workers Receive Lifetime Annuities Marketwatch

How A Single Life Annuity Will Impact Your Retirement Due

Retirement Guide For Conocophillips Employees The Retirement Group

The Basic Principles Of Annuities Ameriprise Financial

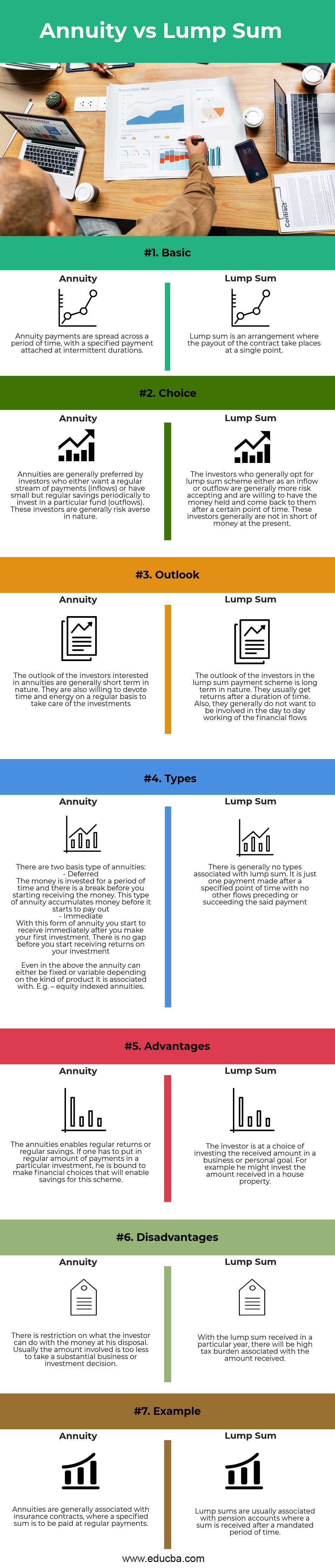

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Boeing Pension Lump Sum Vs Annuity Vs Survivorship

Lottery Payout Options Annuity Vs Lump Sum

Pension Lump Sum Payout Vs Monthly Annuity Keil Financial Partners

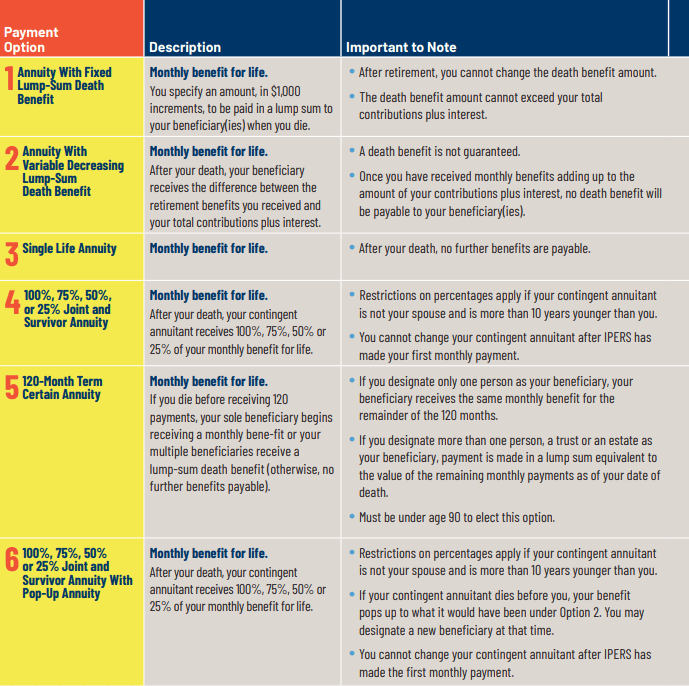

Ipers Retirement Options What Are The Best Ipers Payout Options For You

Lump Sum Vs Annuity Which Should You Take Smartasset

Assurity Annuity Immediate Annuity

Pension Or Lump Sum Compare Payouts And Options Before You Decide Kiplinger

Attention Future Pensioners Act Now Or Lose Thousands Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Annuity Vs Lump Sum What S The Right Choice

What Is An Immediate Annuity Nationwide

Lottery Payout Options Annuity Vs Lump Sum

Income Annuities Immediate And Deferred Seeking Alpha

Difference Between Annuity And Lump Sum Payment Infographics